To facilitate effective, entrepreneurial and prudent management that can deliver the long-term success of the company through system of rules, practices and processes and for balancing the interest of stakeholders, management, customers, suppliers, financiers, government and the community.

In order to carry out its work more effectively, the Board has at the constituent Board Meeting appointed members for a Remuneration Committee and an Audit Committee with special tasks. These committees are the Board's preparatory bodies and do not reduce the Board's overall and joint responsibility for the handling of the Company and the decisions made. All Board members have (save for in case of possible conflicts of interest) access to the same information, enabling them to be jointly and severally liable. Further, certain members of the Board have been selected to form preparatory working groups on topics of special interest such as Corporate Responsibility.

The purpose of this program is to achieve the following objectives:

Fewer Surprises - To ensure that all key business risks are identified, evaluated, controlled and monitored,

Reduce Loss and Increase Reward-To assist the Board and management with their prioritisation and understanding of risks,

Effective Decision Making - To assist management at all levels with prioritising their activities and hereby create room for Hopekins to achieve its strategic objectives.

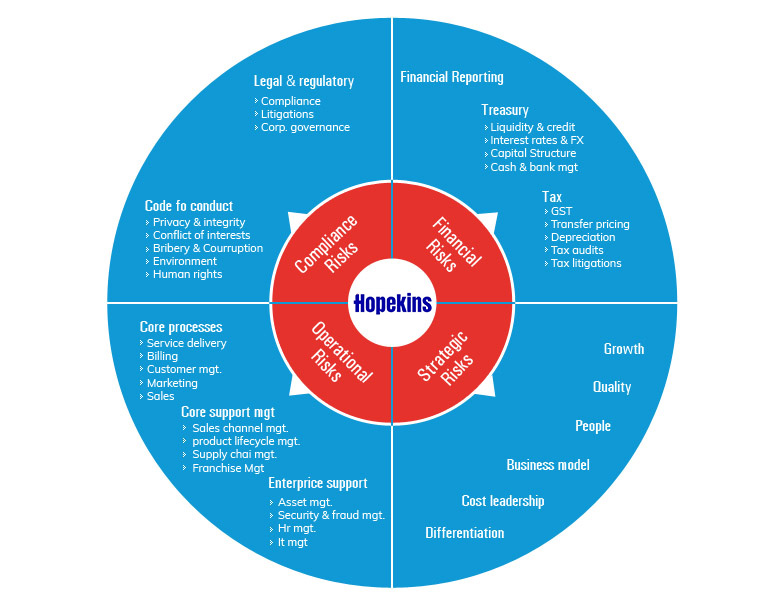

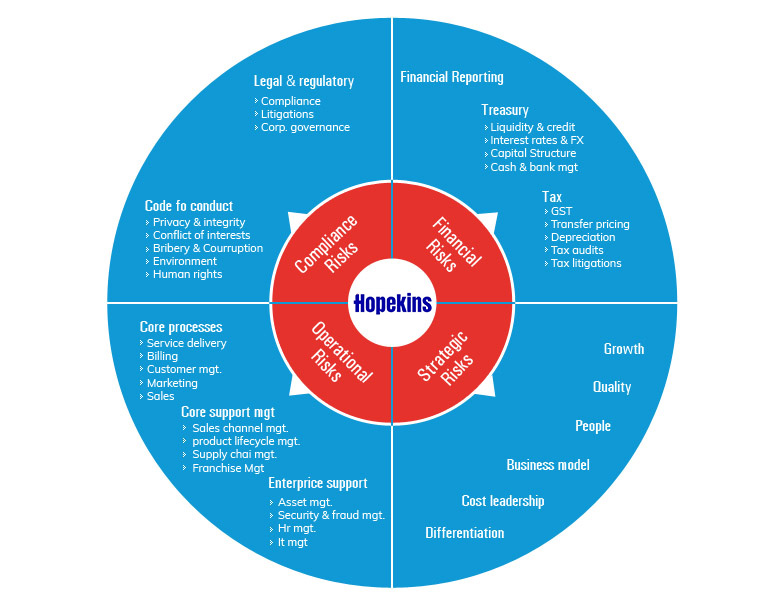

Hopekins bases its risk management program on a proven framework and classifies risks as either Strategic, Operational, Financial or Compliance related. Responsibilities for identifying, monitoring and taking actions in response to those risks vary depending on the classification.

Strategic risks are those which threatens Hopekins ability to achieve its strategic objectives.

Strategic risks are uncertainties related to changes in the operating environment and Hopekins ability to leverage these changes or to prepare for them. External risks are related to changes in the operating environment including, for example, the general economic situation, customers' consumption behaviour, competitors, legislation, technological development etc. Internal risks are related to, for example, the strategy choices made, changes in business operations and mergers and acquisitions. The time frame within which strategic risks and opportunities are assessed is three years, and the aim is to identify the business opportunities which can be exploited to attain the objectives by taking manageable risks, and on the other hand, to avoid those which involve unreasonably high risks. A failure to identify or exploit an opportunity is also a risk.

Group Internal Control is responsible for coordinating the strategic risk assessment and for escalating risks from individual countries to the Leadership Team for discussion and final assessment by the Managing Director & CEO.

Operational risks are risks arising from the normal day-to-day business conducted in the markets where Hopekins operates.

Operational risks are circumstances or damages which can prevent or hinder the attainment of objectives, or cause damage to people, property, business continuity, information or the environment. The aim is to avoid or reduce operational risks, provided however that the cost of controls is in a reasonable proportion to the scope of risk. This includes for example the risk of logistic supply failure, service delivery, system failure or fraud causing loss of revenues or increased costs etc. Management in each market are responsible for identifying and managing the operational risks. In many cases they are supported in this work by central functions who has expertise in specific functional areas and who also are responsible for issuing policies and guidance as a way to mitigate the group's total risk exposure.

The central function Group Internal Control performs regular audits of each business in order to assess the adequacy of each process and to highlight unmitigated risks to management. The result of these audits are also presented to the Group CFO and Group CEO as well as to the Board.

Compliance means conforming to stated requirements (defined for example in laws, regulations, contracts and policies).

Hopekins is subject to specific healthcare treatment or services or pharmaceutical trading requirements imposed by the governments of the countries in which we operate.

Hopekins aims to comply also with these requirements which are expressed through our Code of Conduct (CoC) which have to be signed by both employees and by third parties with which Hopekins deals. Hence, we have an obligation to evaluate how well we are doing in this respect and identify areas where there is a risk of non-compliance and the potential effect of those.

As for the operational risks local management is responsible for ensuring compliance to legal requirements applicable in their countries as well as to the requirements expressed in the Hopekins CoC. The central functions Group Legal and Corporate Responsibility are responsible for issuing guidance, including the CoC, and for consolidating and assessing related risks from a group perspective. Specific aspects of compliance are also assessed by Group Internal Control in internal audits.

Financial risks are risks related to, for example, the availability and price of finance, changes in foreign exchange rates, investment activities, changes in production factor prices, counterparties and credit granting to customers. The management of financial risks is guided by the Group's finance policy, confirmed by Hopekins Board of Directors, as well as Hopekins credit policy with division and company specific specifications. Financial risk management is mainly centralized to the Group Finance Department and Group Tax functions. The aim is to control the Group's financial risks as well as financial costs, and optimize the relation between risk and cost.

Risk appetite is the maximum level of risk that Hopekins is prepared to take at a certain time in pursuit of its objectives. Risk tolerance is the amount of financial resources (such as profit, cash flow, equity ratio) against which risk can be taken. Hopekins Board of Directors determines risk appetite and guides risk taking throughout the Group with active involvement and input from the financial department. Risk taking in relation to risk tolerance is monitored regularly. It is assessed especially in connection with the strategy discussion and when making decisions on business projects or capital expenditures significant for the Group. Indicators of cash flow from operating activities and the Group's solvency, for example, are used in the assessment.